| Investing with a conscious by allocating investment dollars to or away from businesses based on ethical, social, sustainability, or other factors has become increasingly popular over the last decade. Assets pursuing various flavors of these strategies are measured in the trillions of dollars and index providers have been busy manufacturing products for this cause.

A significant amount of research has been devoted to determining how these practices impact investment performance. In other words, does investing with a conscious impose a cost on investors via dampened performance or does karma end up rewarding them with better returns? Thus far, the findings on potential costs appear mixed. Notwithstanding, we believe there is a more important concern to be addressed: Do these conscientious investment policies sensibly target their intended purpose? Unfortunately, I believe the answer is no. Leveraging one’s investment weight to vote for or against various corporate practices is a flawed strategy. In fact, this approach may actually foster precisely the opposite of what is actually intended. This article discusses a specific problem with these strategies and suggests one simple methodology to address it. |

Figure 1: Flawed Transmission Mechanism

Source: Aaron Brask Capital

Background

For the purpose of our discussion, we will use the phrase conscientious investing or investing with a conscious to describe those strategies integrating ethical focus, impact investing, SRI (socially responsible investing), ESG (environmental, social and governance), or similar factors into their investment policies. The basic logic behind these strategies is to use the practice of investing to support corporate practices or businesses one favors and/or avoid supporting those they do not favor.

There has been ample discussion of the performance implications of investing with a conscious. While I have not conducted a comprehensive survey of the research on this topic, it seems clear there is no universal agreement. Some studies find conscientious investing increases returns while others conclude its impact to be negative. I tend to fall into the negative camp for a few reasons:

- Imposing constraints reduces the universe of stocks available to select from and this translates into less opportunity.

- Many sin stocks fall into the value/contrarian category due to the negative stigma and some have been classified as being too risky (e.g., threat of litigation).

- Analytical factor-based studies have normalized results for other drivers of return and indicated the negative impact to be statistically significant.

Whether or not the performance implications are positive or negative, I believe a more important issue has been taken for granted. In particular, how well does the practice of investing with a conscious target the intended businesses?

The Problem

Let us consider sin stocks[1] as an example. The overall purpose of avoiding investments in these stocks is to lower (or at least not help increase) their share prices and valuations. This translates into a higher cost of capital for those companies and thus raises the bar for them to raise money to fund their operations or new projects. This is assumed to have a negative (at least non-positive) impact on these companies.

There is a significant flaw in this logic, however. In particular, many companies tend to buyback their own stock. If the shares of a particular company are cheaper, this actually helps the company and its shareholders. Indeed, if the share prices are lower than they otherwise would have been, then these companies will spend less cash repurchasing shares or perhaps buy more shares back. In either case, the company and its shareholders benefit.

Putting this together, the conscientious investors who intentionally avoided purchasing the shares of sin stocks actually helped some of those companies who were repurchasing their shares.

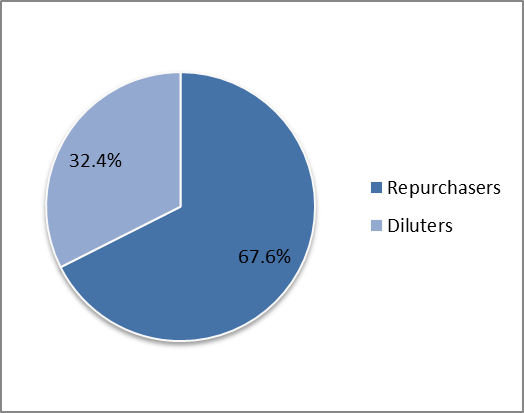

Figure 2: Sin Stocks Tend to Re-purchase Their Shares

Source: Aaron Brask Capital

This leads to another question: Do sin stocks tend to repurchase their shares or not? We analyzed stocks trading on the New York Stock Exchange (NYSE). Judging by the number of shares of common stock outstanding, it appears over 70% of NYSE-listed sin stocks have been net (re)purchasers of their shares over the last three years.

This calls into account the viability of many conscientious investing strategies. The assumed transmission mechanism may actually help the companies and shareholders of the very firms they intended not to support.

A Simple Fix?

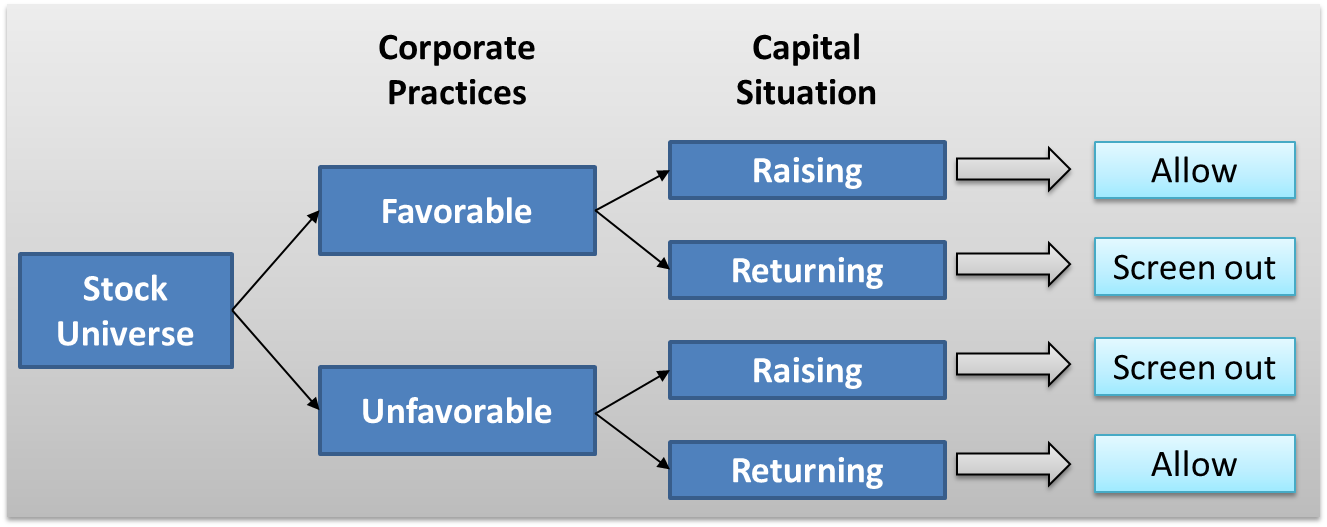

Regardless of the objective or subjective criteria used to define which companies are favorable or unfavorable from a conscientious perspective, we suggest cross referencing the resultant list with another list depicting the magnitudes of corporate buyback activity.

The more general goal should be to help the good companies while not helping the bad companies. A sensible strategy might be to identify the capital needs (e.g., raising capital or returning capital via buybacks) of the targeted firms and make investment decisions contingent on this variable. The simple decision tree below illustrates one simple implementation of this framework.

Figure 3: Integrating Capital Needs

Source: Aaron Brask Capital

Conclusion

Many investors use their investment dollars to target corporate practices they find particularly favorable or unfavorable. However, I find many such efforts may backfire and result in precisely the opposite of what was intended.

For example, one means of expressing one’s disapproval of a company’s corporate practices is to avoid purchasing that company’s shares. However, we find the majority of sin stocks listed on the NYSE tend to repurchase their shares. So lower share prices actually help these firms and their shareholders as it allows the firm to spend less money on buybacks and/or repurchase more shares at a lower price.

To date, I have not seen any press, research articles, or related discussions addressing this significant issue. This lack of consideration further supports my belief the investment industry is quick to tend to marketing demands of brokers and advisors rather than to performance and the needs of actual investors.

Fortunately, it appears there is a relatively straightforward solution. Index providers and practitioners pursuing such strategies should cross reference their lists of favorable and unfavorable companies with the corporate buyback activity of these firms to ensure their implementation of conscientious investing does supports or does not support the correct firms.

About Aaron Brask CapitalMany financial companies make the claim, but our firm is truly different – both in structure and spirit. We are structured as an independent, fee-only registered investment advisor. That means we do not promote any particular products and cannot receive commissions from third parties. In addition to holding us to a fiduciary standard, this structure further removes monetary conflicts of interests and aligns our interests with those of our clients. In terms of spirit, Aaron Brask Capital embodies the ethics, discipline, and expertise of its founder, Aaron Brask. In particular, his analytical background and experience working with some of the most affluent families around the globe have been critical in helping him formulate investment strategies that deliver performance and comfort to his clients. We continually strive to demonstrate our loyalty and value to our clients so they know their financial affairs are being handled with the care and expertise they deserve. |

Disclaimer

|

- We used NYSE-listed sin stocks as defined by www.SinStockReport.com. ↑