If you have ever dealt with Computershare, then you may have experienced subpar customer service. I have had the displeasure of dealing with this company dozens of times and find apathy to be the norm with their customer service. This is a shame because they are effectively serving as an obstacle to many people who are simply trying to access their own assets.

Here are some of the words that have come to mind when I or my clients have interacted with this company:

- Nightmare

- Evil

- Sinister

- Diabolical

- Wicked

- Horrifying

- Terrifying

- Dreadful

- Appalling

So here is the good news: Despite the attitude and administrative mazes you might encounter, it is possible to gain access to your assets held at Computershare and move them to another custodian (e.g., Charles Schwab). So that is the purpose of this article - explaining how to do so.

I have already shared some of my thoughts regarding my belief that they are doing a great disservice to many people. So the rest of this article is focused on two things. I first provide one potential explanation for how or why their service could be so bad. I then share some steps you can take that may help you gain access to and extract your shares from them.

How or why can Computershare be this bad?

When I run into companies that provide poor service, I often wonder: How can a company treat customers like this and stay in business? In my experience, there are two primary reasons.

The first one is that there is an effective monopoly (or duopoly/triopoly) and the companies know there is little or no other competition. So they find they can save money by not investing as much in their products or customer service. Telecommunications companies come to mind (e.g., cable, phone, and internet providers).

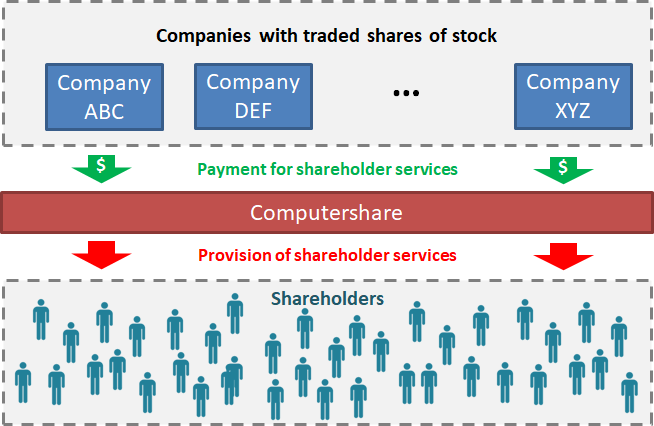

The second reason I have found is that we may be dealing with a company but are not the actual paying customer of the business. In other words, someone else is paying the bills. This is likely the case with Computershare.

Computershare example

Computershare's real customers who pay the bills are the corporations that use them as a transfer agent and for share registry services. In other words, if you are holding shares in company XYZ, then it is likely the case that XYZ is paying them to keep track of their shareholder records and make transfers.

In other words, I think you, as a shareholder, are just someone they are contractually obligated to interact with and provide services to. To be clear, this is just my speculation but the accuracy or inaccuracy of my suspicions does not change the point or utility of this article.

Potential solutions when dealing with Computershare

Enough with the lambasting of Computershare. Let's discuss how you can gain access to your assets and move them somewhere that makes it easy to monitor and manage them. Here are four steps targeting this goal and severing yourself from any and all relationships with Computershare going forward:

1. Take stock of what you own

The first step is to identify all of the assets that you have with Computershare. You may have physical certificates and/or digital shares (a.k.a. direct registration). I recommend calling them (1-877-373-6374) and checking. In particular, ask for all assets tied to your SS number (or EIN if they are held within a trust or business entity).

2. Request recent statement(s)

If you do not already have recent statements that highlight all of your holdings with Computershare, request that they send you the latest statement(s). Recent statements are required for step 4 below.

3. Remove any restrictions

In many cases, your shares may be restricted due to a variety of protocols they have in place. Regardless of the reason, ask if there are any restrictions or "stops" (their jargon) on your shares. If there are, you will likely have to write a letter requesting the removal of these restrictions/stops and mail it to them. Here is a link to a generic letter you may be able to use but here are a few pointers:

- You must fill this letter out with your own details, sign it, and send it to the address listed inside of the letter. Moreover, I suggest sending it via certified mail or some other option that allows you to track its delivery and receipt.

- Dot your i's and cross your t's. It feels like there is an auto-reject on first submissions even if you meticulously follow their verbal instructions. They can be picky about how the request is made. So this may take more than one iteration.

- Be sure to include copies of any physical certificates, if applicable.

4. Move to Charles Schwab or your preferred custodian

Once you get this far, you can move your shares to your preferred custodian (e.g., brokerage account). Please note that it must be like-titled (i.e., you generally cannot move it from one person's account to another person's account - even joint accounts can be tricky). I prefer Charles Schwab but you may want to use another company (I suspect the process will be similar). For Schwab, all you have to do is complete their standard Transfer of Account (TOA) form and include recent statements that identify all of the assets to be transferred.

Computershare rejection letter

Related content

- Illustrating the Value of Retirement Accounts

- Quantifying the Value of Retirement Accounts

- Video discussions on my videos page

- My PDF guide entitled Sensible Strategies to Reduce Your Taxes

You may also learn more about me and my firm here: