Social Security

Background

Social Security (SS) is often the single largest asset one has in retirement. Even for those where SS is not their primary asset, it is typically significant enough to warrant the time and effort to optimize their benefits.

Unfortunately, the SS system is very complex and SS employees are not allowed to provide advice - let alone coordinate SS strategy with their broader retirement assets. Moreover, I have witnessed and heard stories of SS employees giving misinformation (especially around survivor or divorcee benefits). It is not uncommon for their website or statements to contain errors as well.

Your SS benefits will depend on your earnings record but also on whether you are single, married, divorced, or widowed. For example, couples face more than 9,000 different options to choose from (8 years x 12 months = 96 possible months to start benefits for each spouse translates into 9,216 combinations).

The factors above likely contribute to the fact that more than 90% of people on SS do not maximize their benefits. Indeed, I regularly see people

- Missing out on $100,000 or more in their lifetime SS benefits

- Creating unnecessary risk in their retirement

- Triggering taxes that could have easily been avoided or reduced

Given the complexity of the SS system and the importance of coordinating these decisions with your broader retirement plan, I believe it can be helpful to use an expert to make sure you get these decisions right the first time around. Some of the analyses I regularly provide to my clients include:

- Developing a personalized strategy for Social Security decisions based

- Estimating impact of future earnings or salary on SS benefit(s)

- Integrating SS decisions within a broader retirement plan

- Assessing SS cuts into their planning and decision-making

- Fixing bad or no longer optimal SS decisions

Enough with me pitching my services ...

In the following, I highlight information regarding common tasks I find myself regularly explaining to people with questions about SS. Please click on the buttons below to learn about these topics:

Logging into the SSA website Checking out your benefits Getting your SS statement and earnings data Taxation of your SS benefits Related itemsLogging into the SSA website

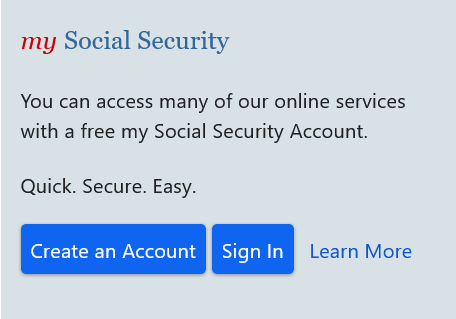

If you are nearing or in retirement, you should log into the SSA website and investigate your potential benefits. This site will only list the benefits based on your earnings history.

If you are divorced and your spouse (even ex-spouse) pre-deceased you, then I recommend calling the SSA at (800)772-1213. You may be entitled to benefits based on their working record(s).

In order to get into your online SSA account, you will need a username and password. First, you will have to go to https://www.ssa.gov/onlineservices/. If you have not already, then you will need to create your own credentials to log into the site. This will involve several security questions (e.g., "Did you live on Maple Avenue or Elm Steet in 1983?") likely sourced from the credit bureaus. I recall feeling some nostalgia when going through this process but have heard that it is easy to get tripped up on some of the specific details.

Signing into Social Security

Once you have established your own credentials, you will be able to sign in to the site. They will likely send a passcode to your email and verify it is you.

Social Security credentials

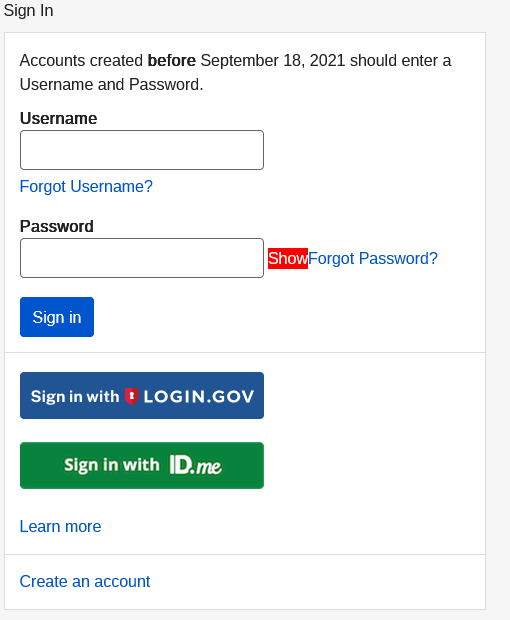

Checking out your benefits

Once you log into the SS site, the first key items you will see are your eligibility status and links to view your historical earnings. Hopefully, you will meet the minimum requirement and be eligible for SS benefits.

Social Security eligibility

There is also a link to view your historical earnings on the site. Note: You could copy/pate the data into a spreadsheet but I explain how to download these in XML format later. This is particularly useful as good planning software can directly digest this data in XML format.

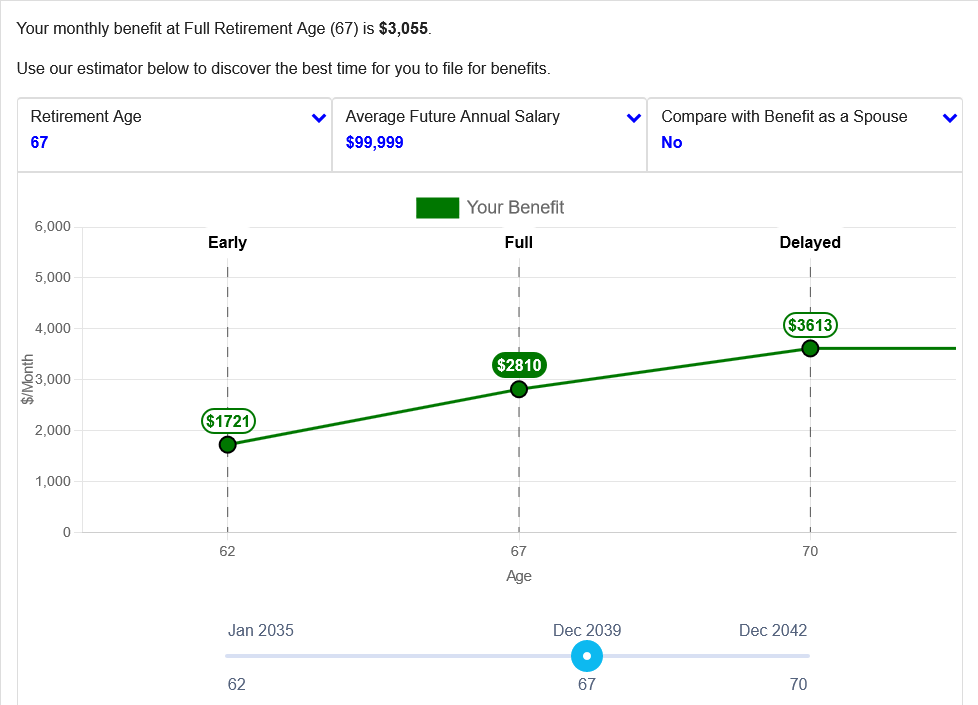

The next thing that will likely catch your eye is their graphical depiction of your estimated SS benefits. You can enter your own inputs to investigate alternative scenarios but I strongly recommend this analysis be done with professional planning software (or a professional who uses it).

Estimated Social Security benefits

Getting your SS statement and earnings data (via XML file)

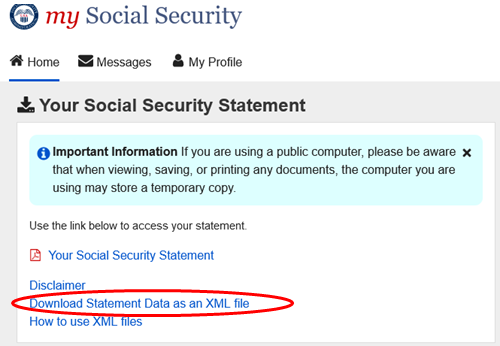

One of the most common tasks people ask me about is how to download your SS statement and/or earnings data in XML format. Your SS statement estimates your benefits and summarizes your earnings history but with limited data (condenses previous decades into single-figure averages). Your earnings data file contains the actual data used to calculate your estimated SS benefits. As mentioned above, this is particularly useful for me and other planners for optimizing decisions around SS.

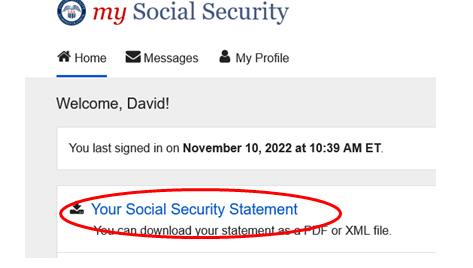

When you are logged in and on the home page, the link highlighted below will take you to a page where you can simply down those files:

Social Security statement download

Here is what that next page and links for the download looks like:

Social Security XML data download

Understanding the taxation of your SS benefits

It surprises many people when they find out taxes may apply to their SS benefits. Depending on how much income you have from other sources, taxes may apply to a certain percentage of your SS benefits. This percentage ranges from 0-85%. To be clear, that is not a tax rate! It is the amount of your SS benefits that are taxable at whatever tax rate is relevant to your situation (e.g., your marginal rate for ordinary income).

The figure they use for income is different from the other income calculations the IRS typically uses (e.g., AGI or MAGI). The IRS calls this figure provisional income and calculate it as follows:

Provisional income = MAGI + 1/2 x SS

MAGI is your modified adjusted gross income and SS is the amount of your SS benefit. As you can see, the taxation of SS partially depends on how much your SS benefit is.

Once you have this figure, then you can use it to calculate how much of your SS benefit is taxable based on the following table:

Provisional income and taxation of your Social Security benefits

| Individual | Married-filing-jointly (MFJ) | % of SS benefits taxable |

|---|---|---|

| Up to $25,000 | Up to $32,000 | 0% |

| > $25,000 | > $32,000 | 50% |

| > $34,000 | > $44,000 | 85% |

Related items

Here are a few other items that you will see within your SSA online account:

- Disability

- Survivor

- Medicare

For those who are interested in learning more about Social Security, I recommend reading Mike Piper's book on Social Security and using his free online Social Security tool. If you really want to roll up your sleeves and don't mind getting technical, then I also recommend Bill Reichenstein's research and software firm - though I believe they stopped offering a consumer-direct product.

Of course, please reach out to me if you would like help with your Social Security or broader retirement planning.

Other content

- Retirement University

- My educational videos

- My blog

- My research articles

- Illustrating the Value of Retirement Accounts

- Quantifying the Value of Retirement Accounts

- My PDF guide entitled Sensible Strategies to Reduce Your Taxes

You may also learn more about me and my firm here: