Qualified Charitable Distributions (QCDs), Donor-advised funds (DAFs), and More

charitable giving

Charitable giving is a multi-dimensional topic. While I highlight many of the relevant factors below, this article primarily focuses on the tax efficiency of three popular methods of charitable giving: Donating your assets directly to charity, using a donor-advised fund (DAF), and using qualified charitable distributions (QCDs). To be sure, this article is not exhaustive. These strategies are the most common and easiest to implement, but I acknowledge that some situations call for more complex strategies. [1]

For broader coverage of charitable giving strategies, I recommend looking at the online resources provided by many of the major custodians (e.g., Charles Schwab).

Table 1: Many dimensions of charitable giving

| Motivation or purpose | What to give | When to give |

|---|---|---|

|

|

|

|

How to give |

Control |

Tax efficiency |

|

|

|

Note: For the purpose of this article, I assume that the intent and means for charitable giving are already in place. That is, one has already made a decision to give. Moreover, they possess the financial means to do so without jeopardizing their own financial security.

Donating your assets directly to charity

One of the simplest and easiest ways to give to a charity is to write them a check. However, this alone does not guarantee you will get any tax benefit. For starters, this amount (in conjunction with other itemized deductions, will have to exceed your current standard deduction. With standard deductions as high as they are now (Over $30,000 for a married couple over 65 years old), this can be a high bar to get over.

One strategy to maximize your itemized and standard deductions when giving is to concentrate your giving in a single year (a.k.a. bunching). Let’s say a married couple planned to give $20,000 cash to a charity in each of the next five years – for a total of $100,000. Since the yearly donation would not exceed their standard deduction (assuming no other itemized deductions), they would take their standard deduction and receive no deduction for their donation.

Instead of spreading the donations over five years, let’s now assume they bunched their five $20,000 donations into one $100,000 in a single year. In this case, they would itemize their deductions and receive a considerable deduction the year they made this gift. Moreover, they could still take their standard deductions in subsequent years.

This bunching approach would significantly increase their deductions and lower their taxes, but there are some constraints involved. They would, of course, need to have the funds on hand to make this larger donation. Moreover, the IRS only allows deductions up to 60% of their adjusted gross income (AGI).

The example above involved a cash donation, but you can also donate non-cash assets. These could liquid investments like stocks or bonds. This could also include illiquid assets such as real estate, private business holdings, fine art, or collectibles. However, the value of illiquid assets will generally have to be substantiated by a third-party appraiser in order to receive a deduction.

One of the primary benefits of donating non-cash assets is the ability to avoid paying any unrealized capital gains on those assets. This is especially useful with highly appreciates assets. For example, let’s say you inherited a stock from your grandfather many years or purchased an investment that skyrocketed (a private investment, IPO, crypto currency, etc.).

If you donated one of these assets, you might receive a significant tax deduction, but you would also avoid paying capital gains taxes on that appreciation. At the same time, the IRS places stricter limits on these types of donations and only allows deductions up to 30% of your AGI.

Donor-advised funds (DAFs)

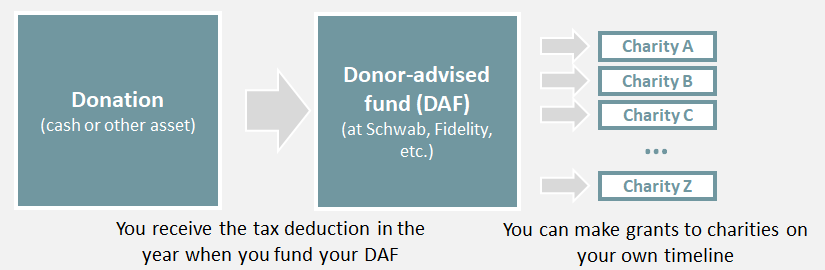

Another option for donating cash or appreciated investments is a donor-advised fund (DAF). The restrictions and tax benefits are similar to donating directly to a particular charity. However, a DAF allows you to separate the timing of the donations and corresponding tax benefits from the timing of the actual gifts.

A DAF is a 501(c)(3) entity that most large custodians (Charles Schwab, Fidelity, Vanguard, as well as others) offer. That is why you receive the same benefits as described above when donating assets to a DAF. To be clear, you will receive no further tax benefit as you would have received a deduction upon donating to the DAF. The DAF is effectively a temporary custodian in that it will hold and invest your donations until you decide to make grants to specific charities.

Donor-advised fund (DAF)

Once you decide on when and how much to donate to particular charities, you simply instruct the DAF to make the grants. You can also include instructions for how the donation will be used (e.g., unrestricted or for a particular purpose) and how you are acknowledged. For example, a charitable organization could receive a gift from the Jane and Jon Doe Giving Fund with a note attached to acknowledge a particular person or reason for the gift.

While the benefits are similar to the previous gifting methods for cash and appreciated assets, this structure provides significantly more flexibility around the timing of the gifts. You can also direct how the funds are invested while they are in the DAF.

One potential downside are the fees involved. The largest and most popular custodians typically charge administrative fees starting around 0.60%, but then decreasing the percentage fee for larger DAF account balances. To be fair, there are costs associated with managing DAFs and making grants, but my opinion is that 0.60% is on the high side for large custodians with their economies of scale. It is also worth noting that these fees would be in addition to any fees associated with the investment funds or an advisor managing the account.

Note: You can find more information on DAFs on Schwab's website here.

Qualified charitable distributions (QCDs)

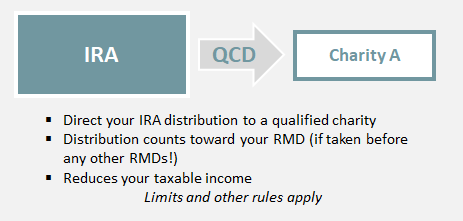

A qualified charitable distribution (QCD) is a distribution from your IRA account to a charitable organization. Even though recent legislation (the SECURE Act of 2019) has moved the required beginning dates (RBDs) out further (to 72, 73, and 75 – depending on when you attain those ages), you are eligible to make QCDs once you are 70 ½ years old. If you are already taking required minimum distributions (RMDs), then QCDs can count toward your RMDs.

When you make a QCD to an eligible charity, it does not count as taxable income. This alone is a key benefit in that this distribution from your IRA would otherwise be taxed as ordinary income (i.e., higher than capital gains tax rates). However, this can potentially trigger additional tax benefits by reducing taxable income.

In particular, QCDs will directly reduce modified adjusted gross income (MAGI). This can be important because MAGI is a direct input into the calculations for:

- Determining how much of one’s Social Security benefits are taxable

- The level of income-related monthly Medicare adjustments (IRMMA)

It is also worth noting that you can still use your standard deduction alongside QCDs. Moreover, QCDs are not limited to a percentage of your AGI like the other tax deductions described above are. There is, however, an annual limit of $100,000 per taxpayer ($200,000 for a couple). This is almost always a higher limit unless one earns more than $1 million a year.

Qualified charitable distribution (QCD)

In my view, these factors make QCDs one of the most powerful tools for maximizing tax-efficiency when giving to charitable organizations. However, there are some important details to keep in mind. For example, order matters when it comes to your RMDs and QCDs.

A QCD will only count toward your RMD if it is taken before you distribute any other RMDs. That is, if you take (some or all of) an RMD and then execute a QCD later in the year, the QCD will not offset the ordinary income triggered by that RMD. In other words, do your QCDs first!

It is also worth mentioning that QCDs cannot be used to fund DAFs or private foundations. This may limit some flexibility in the timing of donations relative to other strategies.

Notes

- You can find more information on QCDs on Schwab's website here.

- QCDs aside, designating charities as beneficiaries on your IRAs (pre-tax accounts in general - IRAs, 401Ks, 403Bs, etc.) can be another tax-efficient charitable giving strategy for many who are not 100% sure they can spare the funds during retirement.

Integrate your direct gifting, donor-advised funds, and qualified charitable distributions within your broader plan

As I highlighted above, charitable giving involves many dimensions. Once you establish charitable intent and financial capacity, tax efficiency is often a critical element to consider. While I hope the factors I discussed above are helpful, you should not consider them in a vacuum. You should incorporate charitable giving into your broader financial and estate planning.

Regardless of one’s wealth, the variables that impact taxes are not independent. For example, QCDs generally mitigate the need for Roth conversions for wealthier taxpayers. At the same time, QCDs can significantly reduce taxes on Social Security for those in lower tax brackets. Everyone's rules of thumb may be intuitive, but optimal planning typically requires professional advice to account for these interdependencies.

The giving strategies I have discussed are relatively simple to implement and easy to understand. I believe this fosters more peace of mind. Unless the magnitude of your giving significantly exceeds the capacity limits of these strategies, I recommend exercising caution around more complex strategies.

Please feel free to contact me. I would greatly appreciate any and all feedback, but I would also be happy to help you with your financial planning needs.

[1] To be sure, there are many other other charitable giving strategies. For example, I have specifically left out charitable gift annuities, charitable remainder trusts, and charitable lead trusts. I think these structures may appear novel and convenient (kill two birds with one stone), but they are generally more complicated from tax and legal perspectives. I also chose not to discuss private foundations. In addition to the potential complexities involved, parties often use these entities for multiple purposes (e.g., tax deductions and creating compensated roles for family members).

Other content

- Retirement University

- My educational videos

- My blog

- My research articles

- Illustrating the Value of Retirement Accounts

- Quantifying the Value of Retirement Accounts

- My PDF guide entitled Sensible Strategies to Reduce Your Taxes

You may also learn more about me and my firm here: