| OVERVIEW

There has been abundant discussion regarding the utility of dividends. Many investment models rely on factors or other strategies in their attempt to increase returns or reduce volatility. These approaches generally focus on total returns and brush dividends under the rug. Some go further and argue specifically against dividends – occasionally likening dividend advocates to sacred cow worshippers. The low dividend yields and strong capital appreciation we have observed in recent years has probably diminished the reputation of dividends as well. On balance, we find the art and science of dividends has largely been forsaken. This is a pro-dividend article. While we acknowledge some issues with dividends (e.g., inefficiencies in how they return capital to shareholders), we find many investors and practitioners do not fully understand or appreciate some of the key attributes that can make dividends useful – especially in the context of retirement income. This article discusses some pros and cons of dividends. We also weigh in on previously-discussed issues and share what we believe are some new perspectives. Some of claims we revisit/challenge are:

As the title suggests, the primary goal of this article is to explain what makes dividends different. We believe it is important to acknowledge the intrinsic fundamental nature of dividends. In particular, this creates a unique value proposition in that dividends can provide investors with a growing stream of income that is largely independent of market volatility. On balance, we believe dividends are a powerful financial planning tool many retirement models seem to neglect. Please stay tuned for our future article(s) were we will present a retirement income strategy that leverages some of the benefits discussed in this article. |

Figure 1: Achieving the same result via different actions

|

|

Source: Aaron Brask Capital

Content summary

We first explain what a dividend is and highlight its fundamental (as opposed to market-based) nature – a critical notion that resonates throughout the rest of the article. We then discuss two key issues regarding how dividends may be an inefficient means of returning capital to shareholders. The following two sections challenge popular claims regarding dividends and how they are related to market returns and buybacks. The penultimate section (before our concluding remarks) discusses the relevance of calculating performance via total returns versus internal rates of return in different contexts and shares related empirical observations.

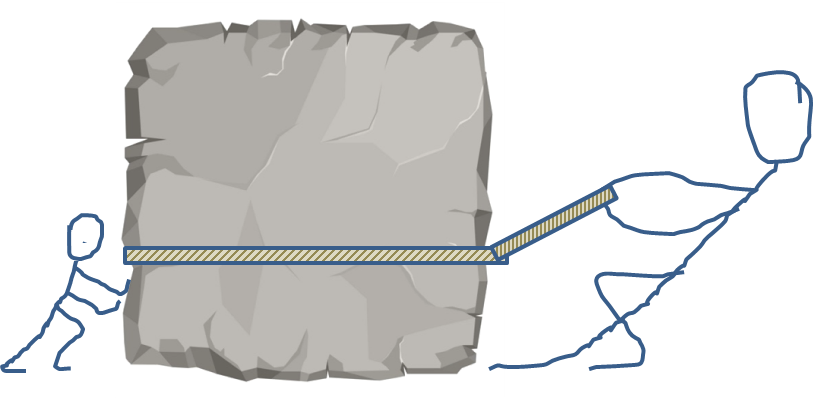

Figure 2: Executive summary

Source: Aaron Brask Capital

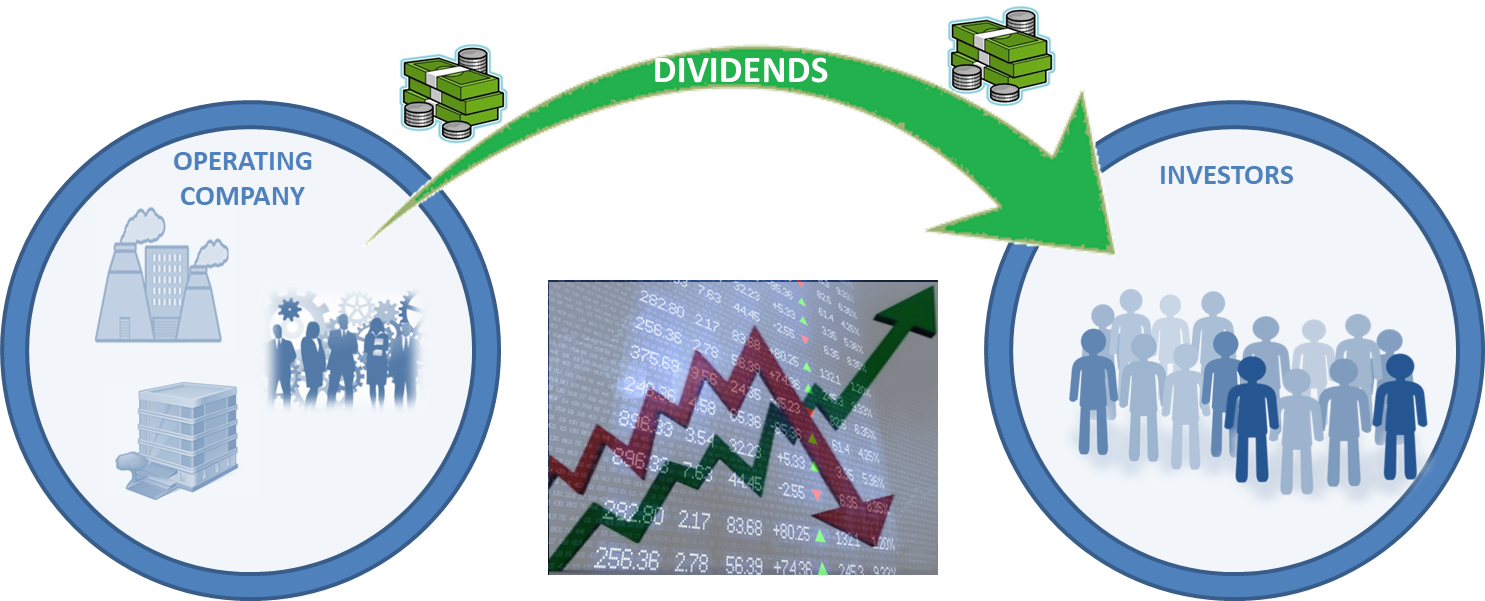

What is a dividend?

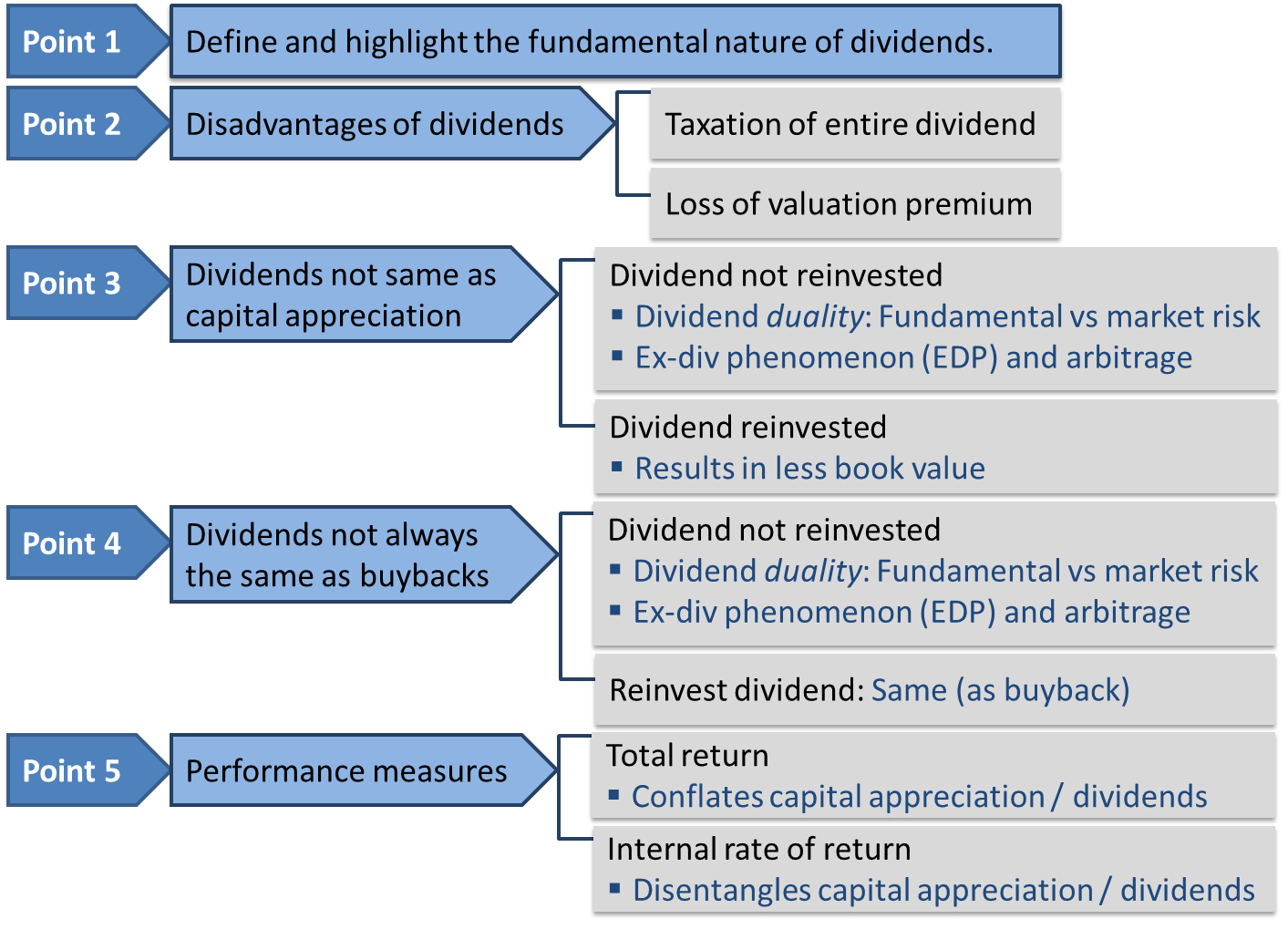

A dividend is a direct cash[1] payment from a company to its shareholders. Of course, if you hold stocks and/or stock funds at a broker or custodian (e.g., Charles Schwab), then they will simply facilitate that payment by transferring the funds from the issuer to your account. In many cases, they will take your dividend and reinvest it by purchasing more shares of the stock via an automated DRIP (dividend reinvestment plan). A key point here is that dividends are paid directly from the operating business to shareholders. So they depend on the fundamental performance of the business and effectively bypass stock market volatility[2].

Figure 3: Dividends bypass market volatility

Source: Aaron Brask Capital

Of course, economic cycles and stock markets are related. For example, market collapses often occur around the same time as recessions. During these periods, the overall market’s fundamental performance (e.g., earnings) can slow or turn negative and result in dividends cuts. Based on these observations, some may be tempted to equate dividend risk and market volatility. However, this logic is not sound.

If we control for cyclical versus non-cyclical businesses (without a look-ahead bias), then the linkages between fundamentals, market prices, and dividends becomes more clear. For example, our data shows that dividends of non-cyclical businesses were significantly more robust than those from cyclical businesses during the last recession (i.e., the credit crisis) and other turbulent periods. While markets may have thrown out the babies (share prices of non-cyclical business) with the bath water (share prices of cyclical businesses), the underlying fundamentals were real drivers of dividend performance. We will revisit this notion and provide more data in our next article.

Another way to recognize the fundamental versus market–based nature of dividends is to consider a private company paying a consistent stream of dividends to its shareholders. Based on the operating performance of the business and management’s decisions, those dividends are 100% fundamental in nature. There isn’t even a market price to consider since it is a private company. Now let us consider what happens if this company went public with an IPO[3] but continued its policy of paying dividends. The company’s shares would trade on an exchange, but such trading would not alter the fundamental nature of the dividend cash flows.

Note: Recognizing this fundamental versus market-based nature of dividends is important as many of the arguments we put forth in the rest of this article rely on it.

Dividend disadvantages

Before we address some common misconceptions regarding dividends, we first acknowledge two related disadvantages. Both of these factors highlight potential inefficiency in how dividends return capital to shareholders.

The first and most straightforward issue relates to taxes. The crux of the disadvantage is that dividends are typically taxed in their entirety. Even if we use the same tax rate (i.e., long-term capital gains rates for qualified dividends), only the capital gain component of stock sold (i.e., not the cost basis) is taxed – not the entire dollar amount of stock sold. In this sense, dividends impose additional tax friction relative to selling one’s holdings and this imposes a real cost.

Assuming a hypothetical (qualified) dividend yield of 2% and long-term capital gains tax rate of 20%, dividends would impose approximately 40 basis points (20% x 2%) of tax drag. If the stock were flat or down, then there would be no capital gains tax for selling shares to create a synthetic[4] dividend. Only holdings with extremely low cost basis (i.e., the position is mostly capital gain) would trigger a similar magnitude of taxes upon selling.

The other issue we highlight relates to valuation. Consider an investor who reinvests dividends in a company. The dividend represents a direct transfer of book value[5] from the balance sheet to the shareholder on a dollar for dollar basis (i.e., each dollar of dividend reduces the book value by one dollar[6]). However, when reinvesting the dividend, this investor will likely repurchase book value at a premium (i.e., the price to book ratio is typically greater than one). This is effectively buying high and selling low (albeit in the opposite order). Warren Buffett touched on this topic and shared an illustrative example in his 2012 annual letter. There are multiple assumptions and nuances embedded his analysis,[7] but the conclusion is straightforward: returning capital via dividends can negatively impact investors.

Returns from dividends are not the same as capital appreciation

Conventional wisdom amongst many academics and practitioners is that dividends are the same as capital appreciation for all intents and purposes.[8] They assume one should be indifferent to receiving dividends versus selling shares to generate the same level of income. We disagree. The following two subsections highlight and refute what we believe are the two most popular pieces of evidence (academic research and the ex-dividend phenomenon) used to argue for dividends’ equivalence to capital appreciation.

Popular research article(s)

Perhaps the most popular research articles commonly referenced in this context is a 1961 paper entitled Dividend Policy, Growth, and the Valuation of Shares by Merton H. Miller and Franco Modigliani (M&M). The article starts out by assuming “... an ideal economy characterized by perfect capital markets, rational behavior, and perfect certainty.” We find each of these assumptions rather unrealistic. So we are naturally skeptical of any conclusions based on all three. Notwithstanding, we will try to highlight where we believe their logic does not gel with the real world.

First, let us consider Buffett’s 2012 annual letter highlighted above where he unambiguously argues dividend policy does matter for investors. Taking Buffett’s words for gospel, we might be tempted to stop there. However, it is more informative to reconcile these two theories and get to the heart of the matter. We break this challenge down into two scenarios: one where the dividend is spent and the other where it is reinvested.

In the case where a dividend is kept or spent (i.e., not reinvested), this income comes directly from the company and is thus fundamental in nature – not impacted by the daily noise in the market. However, if one were to create a synthetic dividend via selling stock, the price of the stock would matter. For example, any market noise on that day (e.g., a Trump tweet) could change the price and hence the number of shares one would need to sell, but would not alter a dividend payment. The essence of risk is different (fundamental vs market-based) and we believe this differentiates real dividends from synthetically generated dividends and capital appreciation, both of which are clearly impacted by market noise.

The potentially more interesting case to consider is when a dividend is reinvested. The discussion and calculation of stock returns[9] in the M&M paper indicates there is an embedded assumption the money would not be spent but remain (re)invested. A fair question to ask is: What if the market prices were different that day? Then the investor would purchase either more or fewer shares with that dividend. Moreover, they would still generally end up owning less book value than if the dividend were not paid. This is due to the transition of each dollar of dividends from the balance sheet to the shareholder. As highlighted above, the market typically values each dollar on the balance sheet at a premium (i.e., the price to book value is usually greater than one). However, once it is passed on to shareholders, it is just a dollar. So when each dollar of dividend is reinvested, it purchases less than one dollar of book value.

The net result is the shareholder owning less book value. If that dollar were left on the balance sheet and put to productive use within the company (even if the marginal rate of ROA or ROE was slightly lower), it would still be valued at a premium. So the payment of a dividend (versus no dividend) clearly has an impact on what shareholders own and thus pokes a hole in the M&M paper’s conclusions.

| Concept: Dividend duality

In our view, dividends represent a unique phenomenon in that they straddle (pierce) the veil between corporate fundamentals and markets prices.[10] The M&M paper ignores this subtle but interesting dichotomy. We are by no means saying this was an intentional omission; it is simply a byproduct of their framework that does not look below the surface of market prices to consider fundamental performance or valuation. Instead, their starting point was efficient markets. So their assumptions did not allow for the possibility of such an inconsistency (i.e., dollars inside the company may be valued more than dollars outside). Of course, it is not surprising there is some discrepancy on the matter since M&M’s assumptions regarding market efficiency are at odds with Buffett’s take on markets and picking stocks. Indeed, one might say our view on fundamentals and markets represents a bottom-up perspective. We believe there are fundamentals and that prices generally follow them over the long run. However, the M&M paper takes a top-down perspective. They effectively assume the market is right and reverse engineer conclusions from there. We suspect this fundamental versus market duality of dividends is not compatible with many of the market models and assumptions used in academia and practice. In their white paper entitled The Dividend Disconnect, Samuel M. Hartzmark and David H. Solomon (H&S) identify and discuss behavioral patterns related to dividends that many investors exhibit. Their paper starts with a quote (from James MacKintosh of the Wall Street Journal) that glorifies dividends as being the rightful “arbiter of stock-market value.” Then they highlight the irrelevance of dividends (versus, say, synthetic dividends or capital appreciation) based on the M&M paper. This concept provides the basis for their analysis whereby they make interesting observations regarding investors’ behaviors around dividends that are seemingly irrational given the assumption of dividend irrelevance. They even go as far as to put forth the notion of the free dividend fallacy whereby some investors may view dividends as being free and not impacting the corresponding stock prices. We find ourselves somewhere in the middle. On one hand, we do not believe dividends are free or that they are the ultimate rightful “arbiter of stock-market value.” On the other hand, we do not find them irrelevant either. Given our healthy respect for dividends and their fundamental/market duality, we find the observations from the H&S paper unsurprising. We suspect many of their conclusions are the result of widely varying utility functions digesting this duality differently. For example, savers in the accumulation phase and retirees focused on income may perceive and value dividends very differently. It may simply be the case that dividend-paying stocks should be analyzed in a different manner than companies that do not pay dividends. Accordingly, many existing market models may need refinement to better accommodate this concept of dividend duality. |

| Geek’s note

Here we mathematically interpret and reconcile the assumptions behind the M&M paper and those described in Buffett’s 2012 annual letter. First their respective formulas for stock returns: ρMM (t)=(p(t+1)+d(t))/p(t) -1 Miller/Modigliani: where ρ represents the return over period t, is the price at time t, and is the dividend paid at time t. ρWB (t)=(p(t)×(1+ROE)-(MTB-1)×d(t))/p(t) -1 Warren Buffett: where is the assumed return on equity and is the assumed market to book ratio (a.k.a. price to book). The first formula is a taken directly from the M&M paper with minor algebraic manipulation. The second formula is our translation of Buffett’s framework from the 2012 annual letter. The real world of fundamentals and markets naturally do not conform to either of these rigid models, but we believe the formulas can help us illustrate a couple points. First, the numerator of the fraction describing Buffett’s return grows book value by the ROE, but then subtracts a second term. That second term effectively represents a penalty for dividends. On the balance sheet, those dollars of equity are valued at a premium (MTB), but they are regular dollars when passed shareholders. Note: In the absence of dividends, the return on the stock is the same as the ROE in his framework – an observation we find sensible. Second, the M&M formula for return involves no fundamental factors. In fact, the returns are exogenously defined so that they are equal for all stocks. So the formula does not represent a function whereby independent variables are combined to calculate a dependent variable (as is the case with the formula based on Buffett’s framework). Instead, the variables on the right side of the equal sign are effectively there to conform to the return on the left side. This effectively highlights the mathematical distinction between the top-down M&M model and Buffett’s bottom-up framework. |

The ex-dividend phenomenon (EDP)

The ex-dividend phenomenon (EDP) describes the pattern whereby stock prices tend to decline by the amount of their dividends once they trade ex-dividend. There is much research supporting this hypothesis and our findings corroborate it as well. However, there are many who cite the EDP as empirical evidence or conclusive proof of the equivalence between dividends and market prices. This is where we disagree. To be sure, we would not be convinced even if ex-dividend price declines perfectly reflected the dividend amounts in every instance.

According to Buffett’s example and our concept of dividend duality, it may be the case that some value is destroyed at the instant when cash for dividends leaves the balance sheet and goes to shareholders. I have not seen or heard of any such models, but it is possible markets decompose stock values into their future reinvested earnings and their dividend stream. These models could even discount the price to reflect the value destruction highlighted above. So dividends would effectively accrue,[11] but they would be valued separately from other book value on the balance sheet.

Under these contrived market model assumptions, dividend duality would no longer be a concern as the balance sheet cash earmarked for dividends would be accounted for separately and could thus make a more seamless transition from the balance sheet to the shareholder – thereby making this efficient market framework perfectly compatible with the EDP.

We simply do not believe markets systematically value stocks this way. Markets are made up of many investors with different utility functions[12] and much market volatility is just noise. In fact, daily stock price volatility is on a similar order of magnitude as ex-dividend adjustments.[13] So we find it presumptuous, if not naïve, to assume markets operate this way when stock price volatility can mask the real mechanics of fundamentals and valuations.

Why is the EDP so prevalent?

The discussion above does not disprove the logic whereby some use the EDP as evidence that dividends and capital appreciation (or synthetic dividends) are equivalent. It merely pokes holes in one theory (our contrived market model) that would be sufficient to equate the two. To call this equivalence further into question, we highlight another theory that could explain the EDP, but still allows for the possibility of dividends being different.

Let us now consider the derivatives market. Unlike cash markets where the activity of buyers and sellers sets prices, most derivatives are priced by arbitrage. That is, their prices do not necessarily reflect traders’ expectations of how those derivatives will perform. Instead, their prices are determined by how much it costs to hedge the derivative risk.

A forward or future contract might serve as a good example. Think of a hypothetical stock XYZ with a current price of $100. The price of a future whereby the stock would be delivered one year from today has nothing to do with futures traders’ expectations for this stock. Instead, they think of the cost of delivering that stock to their counterparty with as little risk as possible. In this case, they borrow $100 at, say, 5% and purchase the stock. They plan to sit on it for a year and then deliver it to the other party. Knowing they will have to repay $105[14] to their creditor, they set the price of the future contract accordingly. Any other price (higher or lower) would leave an arbitrage opportunity on the table.

The key point here is that the derivative price is set by arbitrage assumptions – not market expectations. This introduces another duality; one could have a view on the price of a derivative that differs from the arbitrage price. For a futures contract, this discrepancy is less interesting since a view on the futures contract would effectively just be a view on the underlying. However, it can get more interesting with options or more complex derivative products. For example, Berkshire Hathaway sold some derivatives (basically insurance or put options on equity indices) where the arbitrage-determined prices were higher than their expectations.

The EDP may simply reflect arbitrage. If stocks did not adjust by the amount of the dividend, then there might be an arbitrage. Strictly speaking, the EDP would fall into the category of statistical arbitrage since prices could move overnight based on other factors – noise or real news. Even so, arbitrage theory represents a very plausible (likely in our view) explanation for the EDP.

As Figure 1 indicates (see this link for a more humorous example of confusing cause and correlation), it is not always obvious what the true driver of a particular result is when observing an event. In this case, the ex-dividend price drop clearly reflects the amount of the dividend to some extent. However, we believe it is a mistake to interpret this observation with too much precision. Given the nuances of dividend duality, magnitude of market noise, and the existence of arbitrage as an alternative explanation for the EDP, we find it presumptuous to conclude that dividends and synthetic dividends are equivalent.

Dividends are not always equivalent to buybacks

Let us first state that we agree that dividends are equivalent to buybacks when the dividends are reinvested. In this case, one ends up owning the same amount of book value as they would have had there been no dividend. Of course, taxes and the price one reinvests at[15] may alter things to some degree. However, the key element here is that both scenarios involve the purchase of book value at the same premium. This was not the case when we compared a reinvested dividend to a non-dividend payer.[16]

In the case where dividends are not reinvested in the same stock, dividends are not equivalent to buybacks. This follows from the distinction we made earlier regarding how income is generated. In the case dividends, investors receive a direct stream of cash flows directly from the companies, which makes any market volatility or noise irrelevant. In the case of buybacks, one will be at the mercy of the market when they go to sell shares to create their synthetic dividend. This market dependence makes buybacks intrinsically different than dividends.

Performance measures: Conflating the notions of dividends and capital appreciation

So far, much of this article has focused on understanding dividends and how they are different than capital appreciation. We made the distinction between whether dividends would be reinvested or not to clarify some of our arguments. We now highlight what we believe to be a better way to account for dividends in the context of retirees and other situations where dividends are spent and not reinvested.

For example, those in the accumulation phase (i.e., savers) may be more likely to reinvest dividends whereas those in the decumulation phase (i.e., retirees) might not be. This raises an interesting question regarding market performance calculations. In particular, is the total return (TR) or internal rate of return (IRR) calculation more appropriate?

Perhaps we are ignorant of the literature on the topic and we did not try hard enough to find relevant material, but we did not come across a paper or article that accurately reflected our perspective on the relevance of TR versus IRR for different investment purposes (i.e., saving versus retirement income).[17] Given our view that dividends are different (than, say, capital appreciation), we are naturally cautious about calculations that mix the two together.

The total return calculation conflates the notions of dividends and capital appreciation. When dividends are reinvested, they effectively ride on the back of future capital appreciation. So if one uses TR metrics, the information regarding the contribution from dividends is lost. In other words, you can use capital appreciation and dividends to calculate TR, but you cannot back out capital appreciation or dividend information from TR data.

This is why we believe IRR metrics can be useful – especially in the context where investment income will be spent rather than reinvested. IRR allows one to easily disentangle dividends from capital appreciation. Indeed, you start with an initial investment in a stock (or other asset). Then for any given period, you will have a stream of dividends and the terminal value of the stock at the end. You can calculate the IRR of the capital appreciation alone and then you can calculate the IRR with the dividends.

One might argue you could make similar calculations with and without dividends via TR. However, the key distinction here is that TR calculations depend on the trajectory of the share price – not just the terminal value. The IRR is not impacted if prices go up then down, down then up, or monotonically inch toward their final destination.

To be sure, TR calculations are convenient to use and are stored in thousands of databases. Virtually all academics and practitioners utilize TR for measuring stock performance. We suspect the bifurcation of the investment services industry between security selection and asset allocation[18] reinforces this trend. Indeed, investment advisors typically sift through the universe of funds and other investments based on TRs (and other technical measures like volatility, correlations, etc.) and build portfolios and asset allocations accordingly. So they effectively ignore dividends and that suits their needs.

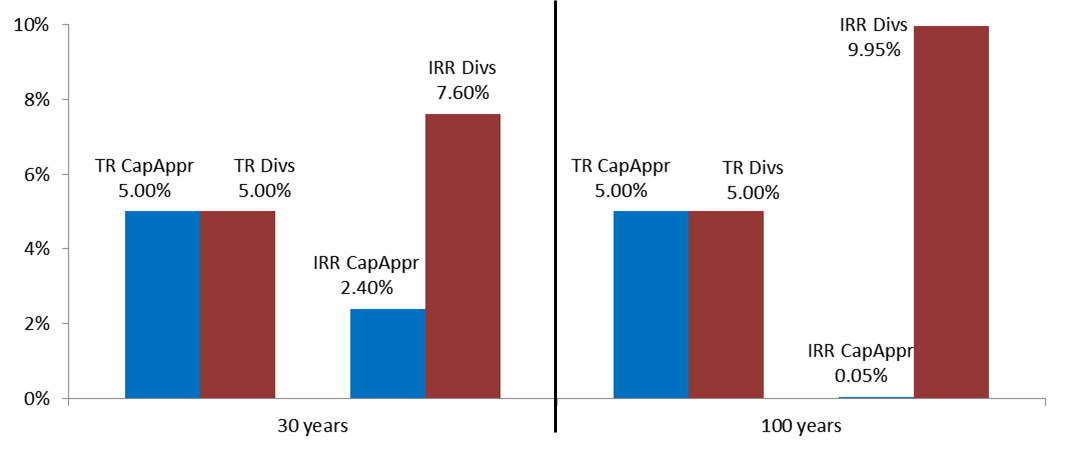

As the British statistician George E.P. Box wrote, “All models are wrong but some are useful.” It is fine if dividends do not play a role in everyone’s models. However, we like to acknowledge the fundamental nature of dividends and the potential utility they can provide, especially in the context of retirement income. So we finish this section with some comparisons of the IRR and TR calculations. The first scenario is hypothetical and assumes share prices and dividends grow at a rate of 5%. The second scenario is based on S&P 500 data index over the last century (1918-2018). We think of this second scenario as a real-world sanity check for the results in our hypothetical scenario.

In a world where share prices and dividends grow by precisely 5% each year, the TR and IRR over every period is 10%. This is simply by construction. What is interesting is the difference between the dividend contributions as measured by TR vs IRR. Let us consider a 30-year period (not atypical for a retirement time horizon). The TR excluding dividends is 5% - again by construction. So that means dividends contributed 5% or half of the TR. However, the dividend contribution when measured by IRR was 7.6%. So the capital appreciation contributed just 2.4% when measured by IRR. If we extended the time period to 100 years, then the dividends claim an even larger share of the contribution – 9.95% of the total 10% return – when measured by IRR.

Figure 4: Dividend contribution depends on context (hypothetical portfolio)

Source: Aaron Brask Capital (Robert Shiller’s online data)

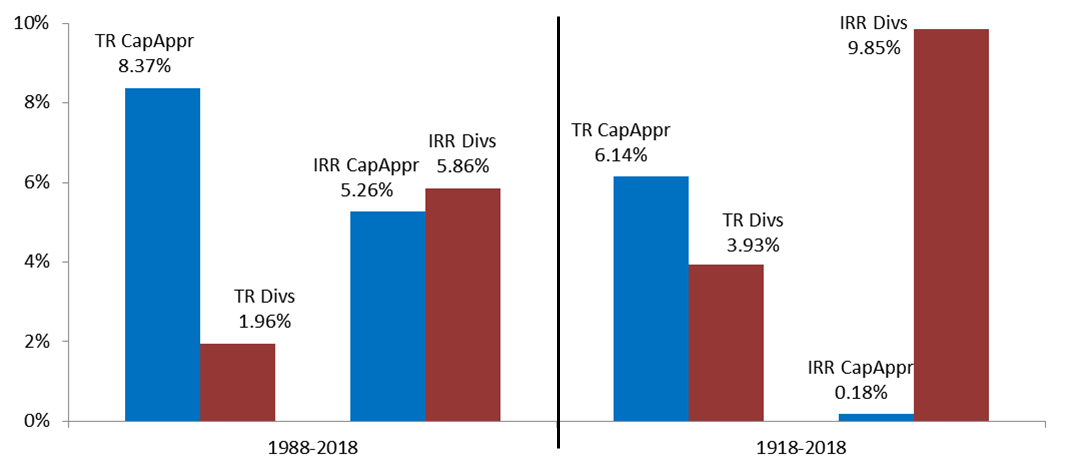

Of course, the above scenario is contrived and the real world does not follow formulaic conventions. So let us look at the second scenario using real data. Over the last 30 years (1988-2018), the S&P 500 TR was approximately[19] 10.3% and dividends contributed 2.0% of this. During the same period, we calculated the IRR to be 11.1% with dividends contributing 5.9%.

Over the last 100 years (1918-2018), the S&P 500 TR was approximately 10.1% and dividends contributed 3.9% of this. During the same period, we calculated the IRR to be 10.0% with dividends contributing 9.8%.

Figure 5: Dividend contribution depends on context (S&P 500)

Source: Aaron Brask Capital (Robert Shiller’s online data)

Of course, much of what we see in these results is just the mathematics of the starting dividend yield and subsequent growth (both dividends and capital appreciation). However, it should be evident that the contribution of dividends is relative – to both the context of the investor and the time frame. This is an important consideration when you come across claims regarding the importance of dividends or how much they contribute to overall market returns. Moreover, this analysis highlights the utility of the IRR metric when one wishes to truly isolate contributions from dividend versus capital appreciation.

Concluding remarks

Why did we write this article? Some might say we just like to quibble over pointless semantics. That is certainly not the case here (though the author is guilty of this sometimes). We are preparing the groundwork for future articles where we will articulate what we believe is a new and innovative retirement income strategy. Dividends are an essential component of this approach, but we simply prefer not to dilute that discussion.

This article addresses some misconceptions and mischaracterizations related to dividends. Some of these are likely the result of what we dub dividend duality. Indeed, dividends’ unique ability to straddle and pierce the corporate veil represents an anomaly that many market models may not be able to properly digest.

We may have beaten this horse to death, but the primary point of this article is to show that dividends are different. In some ways, this is negative (e.g., taxes and loss of valuation premium). In other ways, this can be positive. Given that dividends are direct transfers of assets (typically cash) from companies to shareholders, they can provide growing streams of income that are largely independent of market volatility.

It is important to understand there are different perspectives at play here. There is the decision by each company to pay a dividend (and/or buyback stock) or not. As the CEO of Berkshire Hathaway, Warren Buffett clearly prefers not to pay dividends. We understand his reasoning and do not disagree with his logic.

As investors, however, we are selecting stocks. Some pay dividends and some do not. Even those who are most critical of dividends seem to agree it is not sensible to let the dividend tail wag the dog. That is, dividends may have their disadvantages, but they are not so bad as to avoid them altogether.

Many credible approaches to investing and retirement income (e.g., factor models) still invest in dividend-paying stocks. Some even have higher dividend yields[20] and thus suffer more from the disadvantages we highlighted earlier. So these investment managers are clearly not avoiding dividends payers. We suspect they simply do not want to constrain their opportunity set (i.e., the universe they draw from) as it could have unintended consequences and potentially detract from performance (e.g., bias toward growth stocks which could underperform or be more volatile).

As a parting summary to help avoid ambiguity, here we layout several items we are and are not claiming:

What we are claiming:

|

What we are not claiming:

|

Disclaimer

- This document is provided for informational purposes only.

- We are not endorsing or recommending the purchase or sales of any security.

- We have done our best to present statements of fact and obtain data from reliable sources, but we cannot guarantee the accuracy of any such information.

- Our views and the data they are based on are subject to change at any time.

- Investing involves risks and can result in permanent loss of capital.

- Past performance is not necessarily indicative of future results.

- We strongly suggest consulting an investment advisor before purchasing any security or investment.

- Investments can trigger taxes. Investors should weight tax considerations and seek the advice of a tax professional.

- Our research and analysis may only be quoted or redistributed under specific conditions:

- Aaron Brask Capital has been consulted and granted express permission to do so (written or email).

- Credit is given to Aaron Brask Capital as the source.

- Content must be taken in its intended context and may not be modified to an extent that could possibly cause ambiguity of any of our analysis or conclusions.

- Technically, dividends may take the form of shares of cash, stock, or other property. ↑

- It is possible for market conditions to impact dividend payout decisions. For example, corporate executives may see better opportunities (e.g., buybacks or acquisitions) or may be influenced by a ‘keeping up with the Joneses’ mindset relative to their competitors’ dividend policies. Moreover, buybacks impact future dividends by reducing shares outstanding. So lower or higher market prices could affect the number of shares repurchased and the amount of dividends paid on a per share basis. ↑

- IPO = Initial public offering. This is the process by which a company can sell some of its equity to the public – after which it will have shares trading on a stock exchange. ↑

- A synthetic (or homemade) dividend is a cash flow generated by selling some of one’s shares. ↑

- Technically, dividend actually come out of the assets and retained earnings, but the result is a reduction in book value. ↑

- This assumes no buybacks are taking place at the same time. ↑

- In his example, Buffett relies on book value as a core fundamental metric and uses the price-to-book ratio for valuation (instead of, say, earnings and the price-to-earnings ratio). He also uses return on equity instead of return on assets or other variables. Some may question or alter these specific assumptions (even Buffett himself has questioned the validity of using book value), but we believe the thrust of the argument will still hold. ↑

- Of course, taxes and transaction costs can be relevant. ↑

- They calculate total returns. We discuss this performance calculation (and internal rates of return) later in the article. ↑

- The wave-particle duality of light comes to mind – even if not a perfect analogy. ↑

- Technically, the type of accruing we are referring to is not the same as with bonds where the seller of a bond retains accrued interest. In our scenario with dividends, the accrued dividend goes to the buyer. However, the share price might be valued lower to reflect the idle cash earmarked for the dividend. ↑

- For example, there is much research showing how ex-dividend price trends are impacted by investors with different tax situations. Whether it is stocks, bonds, cash, bread, or butter, we all have different utility functions and this results in the transactions that make up our markets and economies. ↑

- If a stock has an annualized volatility of 16%, then the volatility is approximately 1% on a daily basis. Given that dividend yields are around 2% and dividends are often paid quarterly, the ex-dividend adjustments are on the order on 0.5%. ↑

- We assume no dividends are to be paid over this period. ↑

- There could be a lag between when the stock trades ex-dividend and when investors can reinvest the proceeds (next morning). ↑

- Recall that a dividend is transferred from the balance sheet to the investor dollar for dollar, but then purchases less book value of the company when reinvested, since stocks typically trade at a premium to book value. ↑

- While they did not mention the investment context, one article we came across did at least highlight how total returns conflated the notions of dividends and capital appreciation. ↑

- By security selection, we are referring to the activity conducted by funds and portfolio managers that buy and sell individual securities on a regular basis. These are people investors do not generally meet. Asset allocation is usually done by investment advisors or other financial professionals who deal directly with investors and help them sift through funds and other investments. ↑

- This is only approximate because we are using Robert Shiller’s online data and had to make some assumptions regarding the timing and reinvestment of dividends. ↑

- DFA’s flagship U.S. Large Cap Value Portfolio fund sports a dividend yield higher than that of the S&P 500 index (though lower than the S&P 500 value index). The point is that dividends may be ignored, but are not avoided. ↑