| This article focuses on decision-making trends in the context of security selection and asset allocation that may have significant implications for investors. In particular, there has been tremendous growth in broad market index investing and automated rebalancing strategies. This translates into little to no due diligence regarding the price paid (valuation) or asset quality. This behavior parallels those that led up to the credit crisis.

During the housing bubble, investors at least demanded AAA (well, BBB) stamps to skip due diligence. With index and robo strategies, due diligence is again being set aside as investors are placing their trust in efficient markets. In recent years, this has worked well for those employing this strategy. While I cannot say when, I expect this fad to come to an abrupt and chaotic halt when the music finally stops. To be fair, index products such as exchange-traded funds (ETFs) can be great tools and help many investors (just like collateralized debt obligations or CDOs). However, there is a significant liquidity mismatch between the trading volume of some index products and that of their underlying securities. While index buyers and sellers are close to equilibrium, there may be no problem. However, if an imbalance develops and liquidity spills over into the underlying markets, then we may see significant volatility as the tail starts wagging the dog. |

Figure 1: Index Products Dwarf Underlying Stock Liquidity

Source: Aaron Brask Capital

Overview

This article focuses on the risks posed by a growing number of price-insensitive investors. It is divided into three primary sections followed by a conclusion. In the first section, I discuss problems I identify with broad market indexing and automated rebalancing strategies. I then draw parallels between investor price-insensitivity and credit crisis in the next section. Lastly, I present some numbers to put the risks into perspective.

The Problems

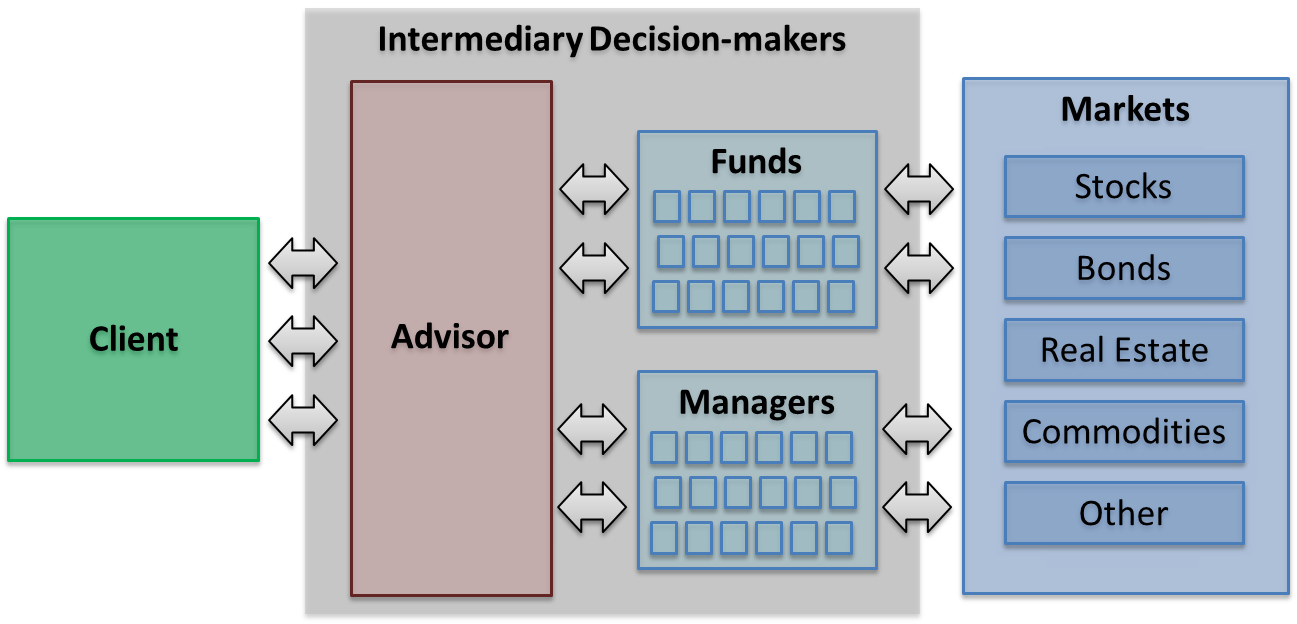

There are two[1] primary decision-makers in the typical investment process: the advisor who selects and maintains an asset allocation and the fund managers who select individual securities. In my mind, thoughtful due diligence should take place at both levels. However, there are strong trends driving many investors in precisely the opposite directions.

Figure : Investment Process Decision-makers

Source: Aaron Brask Capital

Broad Market Index Investing

To be clear, I am an advocate of sensible index investing; it is easy to do much worse than follow the broad market indices. However, I believe this type of index investing has reached critical levels whereby its impact on share prices is significant and dangerous.

As I discussed in my article Index Investing: Low Fees but High Costs (and briefly describe below), broad market index strategies do not employ any risk management other than diversification. Even this is self-defeating to some degree due to the concentration in the largest companies. At the end of the day, they invest in all types of companies (good and bad) at whatever their prevailing valuations happen to be (cheap, fair, expensive).

| Technical Note

Index investing has grown significantly in recent years for good reason, but that it not to say it is not without flaws. Below I highlight three subtle but significant issues with index investing.

|

The theory supporting broad market index strategies assumes the rest of the market participants are actively keeping prices more or less in line so index investors can get a free ride on their due diligence. There are merits to this argument, but there is also irony. In my view, the success and growth of these indexing strategies creates two significant issues.

The first issue relates to the basic premise of relying on the rest of the market to keep prices in line. As the balance of index investors increases, there may be fewer investors left to conduct due diligence. While we are far from this scenario, even Vanguard founder Jack Bogle admits “If everybody indexed, the only word you could use is chaos”.

I believe the second issue is more critical. In particular, the process of blindly allocating capital without regard for quality or valuation can reinforce and magnify mispricing. For example, consider a company that has become overpriced. In other words, its market capitalization is larger than it should be. This gives the company a higher weighting in the index[2]. As each new investment dollar pours into the index, more will go to purchasing the overpriced company than if it were fairly valued. This marginal extra buying pressure could then push the price higher. This process represents a vicious cycle whereby index investing can effectively reinforce and exacerbate overpricing. It is worth noting this phenomenon occurs regardless of whether we can or cannot identify which companies are over or underpriced.

Given the tremendous growth of the index investing industry, this is a legitimate concern. Vanguard’s assets under management reached $4 trillion this January. More concerning is that 20% of that figure was due to growth experienced in just the last three years. While it is one thing to invest blindly, I believe it is important to understand the mechanics of index investing and how they can impact the market.

Asset Allocation

Similar logic and reasoning apply to asset allocation. Robo-advisors, automated rebalancing, and risk-parity portfolios also turn off the manual due diligence process and allow markets to take the steering wheel of their ruled-based investment vehicles. To be fair, many advisors embrace fixed asset allocation approaches. So this is not necessarily an issue with the new technologies for rebalancing, but is still emblematic of the more general trend of blindly following rules without considering the potential implications.

| Technical Note

Not all rebalancing strategies are the same. Below I consider three such approaches and highlight the risks relevant to this context. While the first two may be blind to underlying asset quality and valuation, the third may be more dangerous in that it can systematically exacerbate volatile markets.

These strategies remind of the constant proportion portfolio insurance (CPPI) strategies which were heavily used during the 1980s. CPPI strategies similarly adjusted market exposures based on trailing performance in such a way that market declines triggered more selling. In my view, these dynamics can be quite dangerous. For example, once selling began on Black Monday (October 19, 1987), a vicious cycle ensued and the Dow Jones Industrial Index and S&P 500 both fell by more than 20%. Markets and strategies have evolved since then (e.g., market circuit breakers), but I suspect the chaos that transpired on Monday August 15 of last year is a sign similar risks still lurk beneath the surface of our markets today. |

At the heart of each of these strategies is the notion of diversification (defined with varying levels of sophistication). To quote Warren Buffett: “Diversification is protection against ignorance.” As I discussed in my article, diversification is not the only tool investors should use to understand and manage risk. My point is simply that investors relying on diversification should still conduct a sanity-check on their investments for quality and valuation.

The Skinny

Given the extraordinary efforts of central banks in recent years, the prices and valuations of most assets have been elevated. We no longer have the luxury of investing in safe bonds with healthy yields on the order of 5% like we did before the tech and housing bubbles. In my view, many investors have been scared away from bonds where low returns are more obvious. However, many have also just jumped from the frying pan into the fryer. Valuations in the stock market now exceed those we saw before the credit crisis and rival those seen during the tech bubble. As a result, I believe diversification between stocks and bonds offers the least benefit now relative to any point in the last 50 years.

If markets were not already in such a precarious state, it might be easier to overlook these trends. However, I believe the timing could not be worse. I have already expressed my views on how markets will reconcile with fundamentals in previous articles. So I will take a step back here and describe how I view the bigger picture.

When it comes to investing, the typical advisor-led strategy involves multiple layers of decision-making that impact the returns investors ultimately achieve. At the business level, each company’s management makes decisions that alter its fundamental performance and determine how profits are allocated to investors (i.e., dividends versus buybacks). The market processes this data in aggregate (i.e., market participants buy and sell as they see fit) and fund managers select stocks based on varying combination of fundamentals, management quality, valuation, and other factors. Lastly, advisors select various funds for their client portfolios and rebalance those holdings according to their mandate (e.g. maintain a 60/40 stock/bond allocation).

Given the cozy relationships that exist between many boards of directors and corporate executives, it can be difficult to impose changes at the business level. Thus, the stewardship of fund and portfolio managers who select individual securities becomes more important. In addition to identifying good businesses, they should also ensure management teams pass on sufficient value to their shareholders. Climbing higher up the food chain, advisors should define the appropriate allocation ranges for their clients and allocate capital to quality portfolio managers. In my view, these allocations should reflect the risk profile of the client and also embed forecasts for performance based on the quality and valuations of the assets. Unfortunately, this latter role of due diligence is often missing[3].

These two roles (advisor and fund/portfolio manager) naturally have implications for the performance of client portfolios. If either of these stewards were not present, then the door would open for unnecessary risks to creep into the portfolio. It is fine and well to use technology to displace the advice and expertise of such professionals (which is often conflicted and less competent than one might hope). However, endeavoring to go on autopilot can be extremely especially dangerous when the flight instructions embed flaws than can actually exacerbate market volatility.

I am not trying to guide one on the pros and cons of the above allocation strategies (or their variants). My point is to help readers become aware of these strategies many other investors are pursuing. In particular, I believe it is important to understand how these mechanics and market dynamics may help explain some markets’ seemingly anomalous performance[4]. More importantly, I hope this will prompt some to conduct sanity checks on how their portfolio is being managed and help them prepare for what market may be likely to do going forward.

Parallels to the Credit Crisis

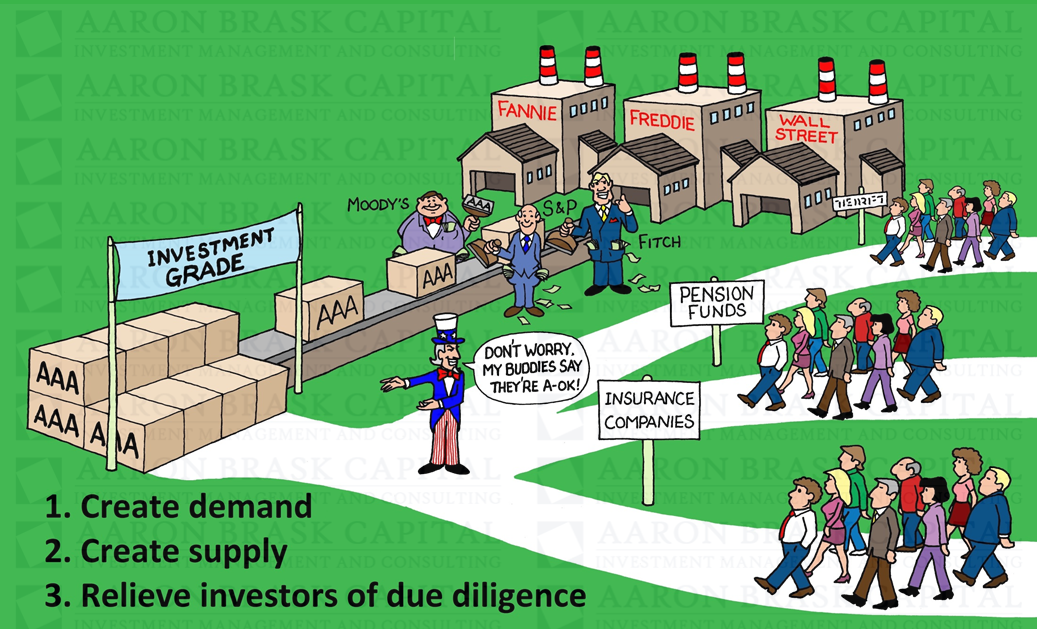

There are clear parallels between the current lack of due diligence now and in the period leading up to the credit crisis. While many market commentators blame the housing bubble on banking deregulation and greed, I have a different view. Going back as far as the 1970s, the securities exchange commission (SEC) allowed (if not encouraged) the investment community to rely on the ratings provided by the major credit ratings agencies. Eventually, the SEC officially endorsed major credit ratings agencies as being nationally recognized statistical ratings organizations (NRSROs).

This move had significant implications. There was a now a government-endorsed oligopoly on the credit ratings that allowed or disallowed investment from many of the largest pools of money in existence. Indeed, the capacity of many entities including banks, insurers, and pensions to invest in credit products hinged on whether or not they were deemed investment grade or not. The NRSROs were the exclusive gatekeepers that provided this stamp of approval.

As time passed, dependency on NRSRO ratings increased both by both regulated and unregulated investors. The investment world was weaned off of credit due diligence and just looked for the ratings agencies’ stamps.

In theory, the economy of scale of the ratings agencies could provide benefits to the investment community. In practice, conflicts of interest evolved making this an unlikely outcome. In particular, the ratings agencies were paid by issuers to rate their credit products.

It was a perfect recipe for a crisis to brew. Many investors were compelled to purchase investment grade credit products. Then they relied on conflicted parties to rate them. Indeed, these agencies had a natural incentive to provide better ratings to attract business (attract repeat business!). This setup was a huge boon to banks, mortgage agencies, ratings agencies, and other parties involved in manufacturing derivative credit products (i.e., CDOs and the like). Moreover, one could argue political motives regarding universal home ownership helped feed this machine the ingredients it needed to create its products.

Figure 3: Recipe for a Crash

Source: Aaron Brask Capital

In short, I believe the root cause or enabler of the credit crisis was the endorsement of the (conflicted) credit ratings agencies. Given the considerable complexity of these products (e.g., the 3-6% tranches of collateralized debt obligations backed by sub-prime mortgages or other derivative assets), what fiduciary in their right mind would have invested money without conducting due diligence? When investors stopped conducting their own due diligence and started relying on the rating agencies, it opened the door for conflicts of interest, capital misallocation, and ultimately culminated in the credit crisis.

While it is easy to blame the banks, I liken the situation to placing a steak on the edge of your lawn. Can you really get mad at your neighbor’s dog for eating it? The ingredients were put in place, the recipe was public knowledge (Fannie Mae and Freddie Mac had been doing this for years), and the table was set with investors waiting to eat. Is it really such a surprise Wall Street could not resist the allure of profits from manufacturing these products?

As the credit crisis unfolded, there were severe liquidity mismatches. In the case of credit products, the derivatives tail wagged the dog. As many of these products were imploding, they ultimately had to be unwound in the underlying credit market. Unfortunately, the derivatives market was magnitudes larger and this bottleneck creates huge price distortions.

I see investors once again ceasing due diligence. This time it relates to their overall investment strategies and there are no ratings agencies. They are simply placing their trust in market efficiency. If history is any indication, this will likely end in tears. As I explain in the Liquidity section, there is again a liquidity mismatch that may become apparent if there is significant selling of index products.

There are also several anecdotal signs of a bubble here:

- ETFs of ETFs: There are now hordes of ETFs that invest in other ETFs. This reminds me of two trends before in the period before the credit crisis. The first was the fund-of-funds craze where fund companies were setup to purchase other hedge funds (as if hedge fund fees were not high enough). Second was the CDO-squared product where remnants of old CDOs were tossed together to create new CDOS of CDOs.

- Proliferation of indices: According to Bloomberg, there are now more indices than stocks in the US.

- Leverage: With investors going to great lengths to buy yield in the markets, leverage has become a popular tool. I have observed some similar themes surfacing in equity products. For example, there are multiple products that take leveraged views on the stock market via shorting[5] the VIX (S&P’s volatility index). Moreover, the first quadruple-leveraged ETFs were just rolled out a few weeks ago.

Looking at Some Numbers: Tail Wagging the Dog?

In this section I observe the market from three different angles. First, I observe valuations and compare them to those before the tech and housing bubbles. Second, I look at the relative magnitudes of liquidity in S&P 500 index products versus its underlying constituents. Lastly, I highlight two more buckets of investors who tend to exacerbate market moves with their pro-cyclical buying and selling patterns.

Valuations

One place market folly can show up is in valuations. While many do not see the forest for the trees, high valuations have historically resulted in dismal returns in subsequent years. Indeed, high valuations were evident leading up to both the tech bubble and credit crisis collapses. We know how those stories ended. Unfortunately, valuations are now higher than before the credit crisis and rivaling those seen during the tech bubble.

Based on forecasts by GMO[6], large US equity is the most overvalued of all asset classes. They expect a -3.8% real[7] return over the next seven years (this translates into a 30% loss of purchasing power). It is worth noting this forecast is worse than their estimate for US large caps (and every other asset class) before the credit crisis. Moreover, their current forecasts are lower now for every asset class expect international small cap and emerging market equities. That is why the current market is sometimes referred to as the ‘everything bubble.’

If you are interested in reading more about the relationship between valuation and market performance, please read my articles More Market Correction to Come, The Non-credit Crisis, and Tea Leaves.

Liquidity Mismatch

One worrisome observation about the current market is the liquidity mismatch between index products and their underlying constituents. Futures, ETFs, and other index products have become immensely popular trading vehicles. In fact, they have become so popular that some of their (dollar) trading volumes outweigh those of their underlying constituents.

Figure : Index Products Dwarf Underlying Stock Liquidity

Source: Aaron Brask Capital

Figure 4 above illustrates this case for S&P 500 index products. In particular, the average daily trading volume for the S&P 500 e-mini futures is approximately $140 billion per day. The SPDR S&P 500 ETF Trust (ticker: SPY) trades another $20bn per day. However, the underlying stocks of the S&P 500 index only trade about $34 billion per day. So the trading volume of these two index products is almost five times the volume in the underlying shares.

Given the massive growth of index products in recent years, the creation of new ETF shares has resulted in net buying activity at the stock level. So I suspect this has been a major driver of the recent bull market. Even without this driver, the buyers and sellers of the index products might just trade amongst themselves. In this case there may be no problem as the volume might not spill over into the underlying stocks.

I am concerned with the flip side of the growth situation. Significant problems may arise if markets take a turn south. If that is the case and a significant imbalance develops at the index product level, the underlying stocks may not be able to withstand the magnitude of volume that spills into their market. Given the autopilot nature of the strategies that got markets to this point, it would not surprise me if index investors’ beliefs in efficient markets get shaken and create just such an imbalance.

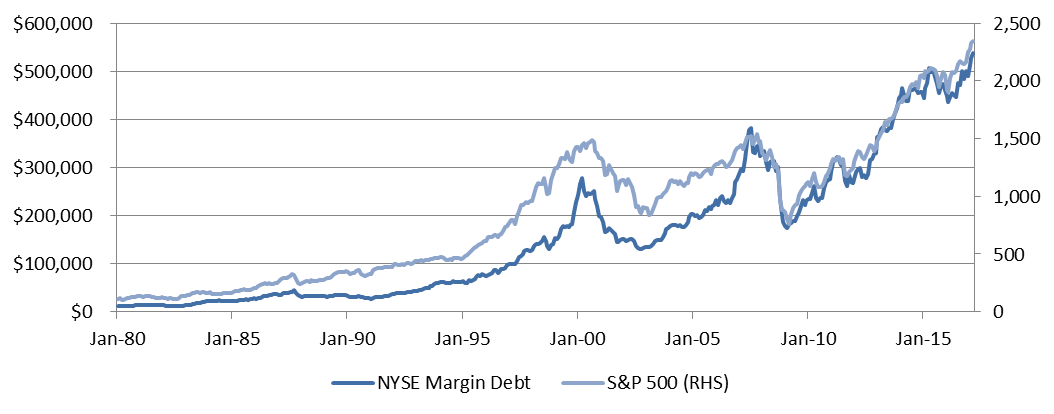

Two More Cyclical Investors

In addition to the autopilot investors whom I suspect will exacerbate or intensify future market declines, there are two other groups of investors who also tend to buy and sell in a cyclical pattern. The first group is margin investors. These investors borrow money to purchase shares of stocks. This leverage tends to be employed by more speculative investors. As Figure 5 below illustrates, many of these margin investors tend to evaporate during market declines and thus contribute to the market selling.

Source: Aaron Brask Capital, NYSE, S&P

Right now margin debt on the NYSE[8] is at a record high – more than 40% above its previous peak. Previous market declines saw margin debt fall by a bit more than 50%. If that were the case going forward, this would amount to approximately $225 billion in selling. This translates into seven entire days of average stock volume (though, of course, this selling would occur over a longer period).

Figure 6: S&P 500 Buybacks ($bn)

Source: FactSet

Another group of cyclical investors are companies themselves. The bulk of their share repurchases occur during bull market periods but typically come to a screeching halt during market declines. Figure 6 above illustrates this phenomenon during the credit crisis. This naturally reduces the pool of buyers significantly. The simultaneous increased selling by margin investors and reduced buying by companies likely contributed to the violent nature of the last two major market declines (i.e., the tech and housing bubbles). I do not expect this time to be any different.

Conclusions

My primary goal with this article is to highlight the lack of due diligence that is currently taking place as well as potential implications for investors. The trend toward automated rebalancing strategies and broad market index investing not only enables markets and individual securities to deviate from their fundamentals, but it can also reinforce or exacerbate it.

In my view, lack of due diligence was the primary driver of the credit crisis. At least then investors demanded some sort of rubber stamp indicating the credit quality. Now they are relying solely on their belief in efficient markets. As sentiment surveys have shown historically, investors’ beliefs can turn on a dime.

Lack of due diligence is not the only similarity between investors today and then. Indeed, the same types of products are surfacing and there is widespread use of leverage in various forms (e.g., 4x leveraged ETFs, VIX-based funds, ETFs of ETFs, etc.). Moreover, there is a significant mismatch between the liquidity of many of these products and their underlying securities.

As I wrote in my previous article Tea Leaves, there are signs that corporate fundamentals and the economy are slowing. Given the backdrop of investor optimism and elevated market valuations, I believe the same market dynamics that helped propel the market to its current state will eventually turn and exacerbate future volatility and accelerate market declines.

About Aaron Brask CapitalMany financial companies make the claim, but our firm is truly different – both in structure and spirit. We are structured as an independent, fee-only registered investment advisor. That means we do not promote any particular products and cannot receive commissions from third parties. In addition to holding us to a fiduciary standard, this structure further removes monetary conflicts of interests and aligns our interests with those of our clients. In terms of spirit, Aaron Brask Capital embodies the ethics, discipline, and expertise of its founder, Aaron Brask. In particular, his analytical background and experience working with some of the most affluent families around the globe have been critical in helping him formulate investment strategies that deliver performance and comfort to his clients. We continually strive to demonstrate our loyalty and value to our clients so they know their financial affairs are being handled with the care and expertise they deserve. |

Disclaimer

|

- Note: Actually, I would argue there is a third but it is beyond the scope of this article. I am referring to the corporate management teams who run the businesses and distribute profits to shareholders. ↑

- I am assuming market capitalization weighted index weightings. ↑

- William Jahnke described in his 1997 paper The Asset Allocation Hoax how many investment managers happily rely on fixed asset allocation strategies since it “conveniently shelters both the consultant and the investment manager from the most important investment decision.” The more general purpose of his paper was to expose the misinterpretation of a previous study than many advisors cited to promote fixed asset allocation strategies. ↑

- There appears to be an almost insatiable thirst for bonds regardless of low and even negative yields in some cases. Stocks in aggregate have defied the gravity of lofty valuations for years now. Numerous headlines have highlighted the top-heavy nature of stock returns (e.g., AAPL has contributed 102% of the Dow Jones Industrial performance year-to-date). ↑

- Volatility and market direction are negatively correlated. So taking short positions in the VIX results in leveraged exposure to the underlying market (in this case, the S&P 500 index). ↑

- Grantham, Mayo, & van Otterloo is a reputable investment firm that has an impressive history of market forecasts. Their current and historical market forecasts are freely available on their website www.gmo.com. ↑

- Inflation adjusted ↑

- New York Stock Exchange ↑